One of the most important considerations for buying a home is actually the mortgage interest rates. A single percent in interest can mean a significant increase in how much money one pays over their life of the loan. Whether or not one is a first-time home buyer or looking to refinance, working through mortgage interest rates can save people thousands of dollars and help them make better financial decisions.

What are Mortgage Interest Rates?

A mortgage interest rate is the percentage charged by a lender on the money you borrow to purchase a home. This rate is added to the principal loan amount and determines how much you’ll pay each month and over the full term of the mortgage.

For example, if you borrow $300,000 at a 6% interest rate on a 30-year fixed mortgage, your total repayment amount will be significantly higher than just the $300,000 you initially borrowed.

Why Do Mortgage Interest Rates Matter?

The interest rate on your mortgage affects:

- Your monthly payments

- The total cost of your home

- How quickly you build equity

- Your ability to qualify for a loan

Even a 1% difference in mortgage interest rates can add up to tens of thousands of dollars over time.

Fixed vs. Adjustable Mortgage Interest Rates

There are two main types of mortgage interest rates:

1. Fixed-Rate Mortgages

- The interest rate remains the same throughout the life of the loan.

- Ideal for buyers who want consistent monthly payments.

- Best suited for long-term homeowners.

2. Adjustable-Rate Mortgages (ARMs)

- The interest rate can change periodically based on market conditions.

- Usually starts with a lower rate for an initial period.

- Better for those who plan to sell or refinance in a few years.

What Affects Mortgage Interest Rates?

Several factors influence the rates lenders offer:

- Credit Score

Higher credit scores typically qualify for lower mortgage interest rates. Lenders see you as less risky.

- Loan Type

Conventional, FHA, VA, and jumbo loans can have different interest rates.

- Loan Term

Shorter loans (like 15-year mortgages) often have lower interest rates than longer ones (like 30-year mortgages).

- Down Payment

A higher down payment reduces your loan-to-value ratio and can lower your interest rate.

- Economic Conditions

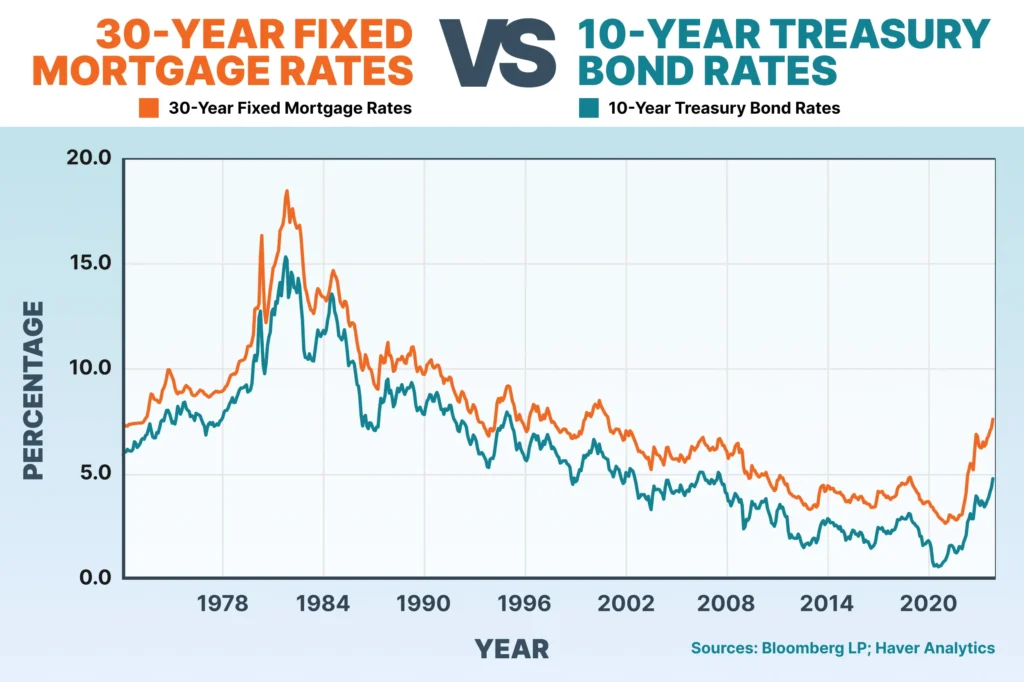

Inflation, the Federal Reserve’s monetary policy, and market demand all impact average mortgage interest rates nationally.

How to Get the Best Mortgage Interest Rates

Here are practical tips to secure a low mortgage interest rate:

- Improve your credit score before applying

- Compare rates from multiple lenders

- Pay points to reduce your rate (if it makes sense long term)

- Make a larger down payment

- Consider a shorter loan term

- Lock in your rate at the right time

Current Trends in Mortgage Interest Rates

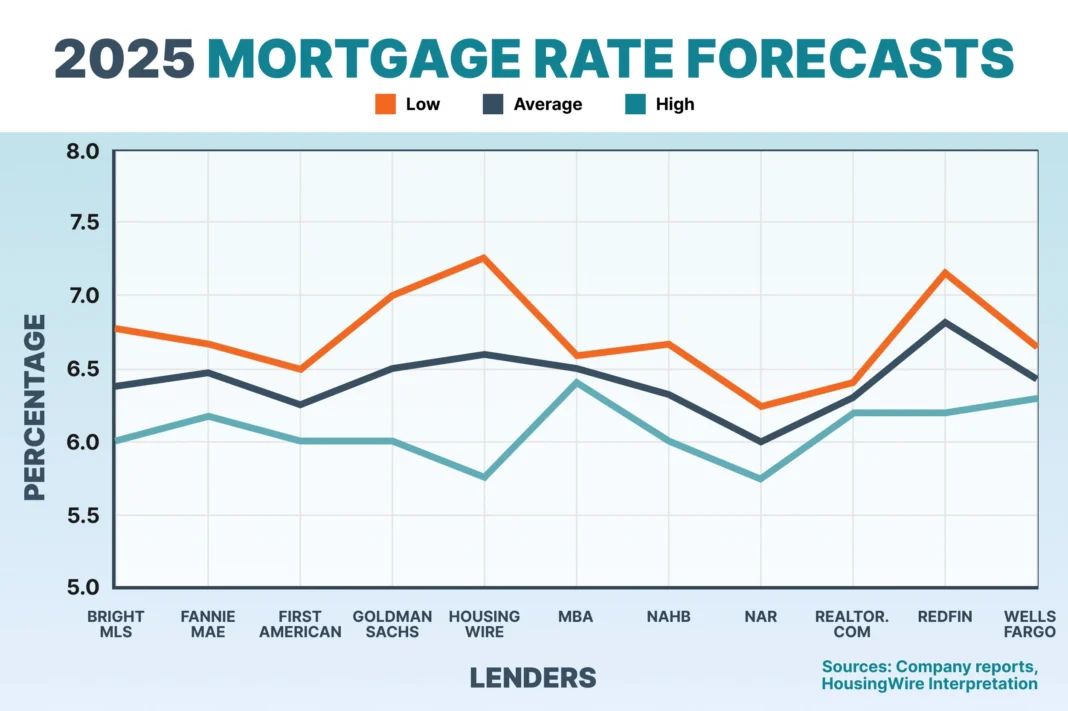

As of mid-2025, home loan rates are still responding to pandemic-post post-inflation control efforts. The Federal Reserve has varied rates several times, and lenders are adjusting in response. Rates are more volatile now, and application timing is more important than ever.

Some forecasters anticipate that rates will settle in the coming year, but others say volatility will persist based on economic indicators such as the unemployment rate, GDP growth, and inflation gauges.

Frequently Asked Questions (FAQs)

- What is a good mortgage interest rate in 2025?

A “good” rate is relative to the market, your credit profile, and loan type. As of now, anything under 6% for a 30-year fixed mortgage is considered competitive.

- How often do mortgage interest rates change?

Rates can change daily based on the bond market, inflation reports, and economic indicators. Always check multiple sources or use a mortgage rate tracker.

- Can I negotiate my mortgage interest rate?

Yes. While you can’t haggle like at a flea market, shopping around and comparing offers gives you leverage. You can also ask your lender to match or beat a competitor’s rate.

- Do I need to pay to lower my mortgage interest rate?

You can buy “discount points” to lower your rate. Each point costs about 1% of the loan amount and typically lowers the interest rate by 0.25%.

- Is it better to get a fixed or adjustable rate mortgage?

Fixed is better for stability and long-term plans. Adjustments may be better if you plan to sell or refinance within a few years. Each has pros and cons based on your goals.

- How does my credit score affect my mortgage interest rate?

The better your credit score, the lower the risk you pose to lenders. That means a lower interest rate. A score of 740 or higher will generally unlock the best rates.

- How can I lock in a mortgage rate?

Once you find a good rate, ask your lender about the possibility of a rate lock. This locks that rate into place for a certain period (usually 30 to 60 days) as you complete the loan process.

- Should I wait for mortgage interest rates to drop before buying?

It might pay off, but it’s a gamble. The prices can go higher, and homes will go higher in prices. If you do find a good deal and are able to afford it, then locking it in now can save you money, on average, in the long run.

- Can you refinance if mortgage rates drop?

Yes. You can refinance your old loan with a new one that has a better interest rate. Just make sure that savings outweigh the refinancing costs.

- Do online mortgage rate calculators give accurate results?

They give estimates but aren’t final. Use them as a guide, but speak to a lender for a personalized quote based on your full financial profile.

Final Thoughts

Understanding mortgage interest rates is essential whether you’re buying your first home, refinancing an existing loan, or simply exploring your financial options. These rates determine how much house you can afford, how much you’ll pay over time, and whether now is the right time to act.

Always keep an eye on market trends, work on your credit, and shop around. The more informed you are, the more confident and prepared you’ll be to make a smart home financing decision.