In assessing the wellbeing of the U.S. economy and overall stock market, there are few gauges more important than the S&P 500. This benchmark stock index gives us a quick look at how America’s largest-cap corporations are doing, giving investors, analysts, and anyone curious about the financial universe essential information.

No matter if you’re an investing novice or looking to polish your knowledge of market trends, this article distills what the S& P 500 is, why it’s important, how it works, and how you can leverage it to make better financial choices.

What Is the S&P 500?

The S&P 500 (also known as Standard & Poor’s 500) is a stock market index that monitors the performance of 500 of the biggest publicly traded companies in the United States. The companies operate across different industries such as technology, healthcare, finance, consumer goods, energy, and others.

In contrast to certain price-weighted indices, the S& P 500 is weighted according to market capitalization, and firms with a higher total market cap have more influence on the movement of the index. This makes it a strong and realistic reflection of the U.S. equity market.

Why the S&P 500 Is So Important

- Broad Market Exposure

The index represents approximately 80% of the entire value of the U.S. stock market and serves as a solid gauge of overall economic condition and sentiment in the market.

- Reliable Investment Benchmark

The S&P 500 is widely used as a performance benchmark by many mutual funds, ETFs, and retirement funds.

It’s also widely used as a base for index funds.

- Trusted Economic Indicator

Movements in the S& P 500 tend to be a proxy for investor optimism, corporate fitness, and economic prospects. It may move up or down in response to changes in interest rates, inflation reports, GDP growth, and geopolitical events.

How Companies Are Chosen

Not every company is included in the S&P 500. In order to be selected, a company must satisfy certain requirements:

- Have at least $14.5 billion of market capitalization (as of 2024)

- Be a U.S. company

- Have at least 50% of shares publicly available

- Report positive earnings in recent quarters

- Be listed on a major U.S. exchange such as the NYSE or NASDAQ

The list is maintained by the S&P Dow Jones Indices committee, which reviews and updates the index periodically to ensure it remains representative of the current market.

How to Invest in the S&P 500

You can’t purchase the index directly, but you can invest in products tracking it, including:

- S&P 500 ETFs (such as SPY, VOO, or IVV)

- Index mutual funds

- Robo-advisors that invest money based on S& P 500 performance

These investments provide diversified exposure, cheaper fees, and historically high long-term returns, so they are a favorite among new and experienced investors alike.

🔹 Pro Tip: If you’re new to the game, try setting up regular automatic investments into an S& P 500 index fund in your brokerage account or retirement plan.

How S&P 500 Stacks Up Against Other Indices

- Dow Jones Industrial Average: Only 30 large-cap stocks it tracks are price-weighted.

- NASDAQ Composite: Very tech-heavy and includes over 3,000 stocks.

- Russell 2000: It tracks small-cap U.S. stocks and provides a view of the performance of small companies emerging.

The S& P 500 is widely favored for its combination of size, sector diversity, and past performance.

What Impacts the S&P 500 Performance?

The index is influenced by a mix of macroeconomic and firm-specific variables, such as:

- Federal Reserve interest rate changes

- Inflation reports

- Earnings season for companies

- Unemployment numbers and GDP data

- Government policies and geopolitical events

Keeping an eye on these variables can prepare you to predict short- and long-term market movements.

Frequently Asked Questions (FAQs)

- Is the S&P 500 a good investment for new investors?

Yes. Its diversification and healthy long-term historical returns make it a great option for someone just beginning to invest. S&P 500 index funds and ETFs are easy to maintain and affordable.

- How often does the S&P 500 change?

The index is checked on a quarterly basis. Firms can be added or dropped based on whether they qualify in accordance with the S&P Dow Jones Indices committee.

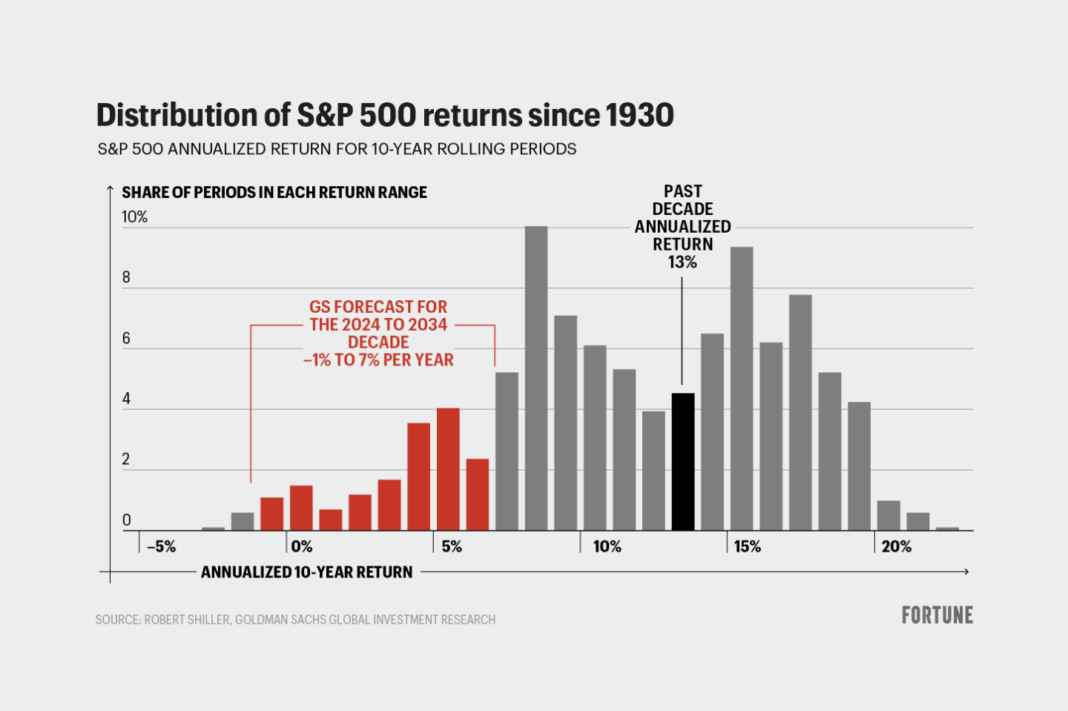

- What’s the historical average return of the S&P 500?

Historically, the S&P 500 has averaged 7%–10% per year after inflation. Yet prior performance doesn’t ensure future results.

- Can the S&P 500 decline?

Yes, as with all market indices, the S&P 500 may fall because of economic slump, market correction, or other world events. Nevertheless, in the long run, it has always gone in an upward direction.

- How can I monitor the S&P 500 in real-time?

You can follow it on leading financial news websites such as CNBC, Bloomberg, or Yahoo Finance. Most of the brokerage sites also provide real-time quotes and charts.

Advantages of Tracking the S&P 500

✅ Diversification across various sectors is simple

✅ Affordable access through index funds and ETFs

✅ Reduced risk compared to direct investment in individual stocks

✅ Clear and traceable performance information

Following the S&P 500 may assist individuals in being aware of the health of the market and making rational investment decisions based on recent trends.

How the S&P 500 Impacts Your Daily Life

Even if you aren’t making active investments, the S&P 500 has more of an influence on your life than you realize. S&P 500-linked funds are commonly found in retirement options such as 401(k)s and IRAs. The index also has an impact on business confidence, interest rates, employment markets, and housing costs.

For professionals, knowing how the market operates can also be essential to making sound choices, whether you’re running a business, deciding on a career change, or considering a loan.

Final Thoughts

The S&P 500 is much more than a set of numbers—it’s a trusted barometer for the U.S. economy, a powerful investment tool, and a vital resource for anyone seeking financial clarity. Whether you’re planning for retirement, learning about the market, or actively trading, understanding how this index works can elevate your financial confidence and knowledge.