The Dow Jones today represents more than just numbers on a screen—it’s a real-time pulse of the U.S. economy and a reflection of investor sentiment across industries. Whether you’re a seasoned trader, a casual investor, or simply someone trying to make sense of financial news, knowing how to interpret the movements of the Dow Jones Industrial Average (DJIA) is essential.

What Is the Dow Jones Industrial Average?

The Dow Jones Industrial Average, which is sometimes just called the Dow, is one of the world’s oldest and best followed stock market indexes. It follows the progress of 30 large, publicly traded U.S. companies across different sectors such as technology, finance, healthcare, and consumer goods. They are industry leaders and give an overview of general economic trends.

Why the Dow Jones Matters

When individuals inquire as to the condition of the marketplace, they tend to glance at the performance of the Dow Jones for the day. This is because the Dow is an index that acts as a standard gauge of the health and trajectory of the U.S. stock market. Though not as detailed as the S&P 500, which encompasses 500 firms, the Dow’s history and stature make it an important tool both for analysts and ordinary investors.

🔹 Quick Fact: The Dow does not calculate stocks based on market cap. It instead employs a price-weighted formula, whereby firms with higher-priced stocks contribute more to the index.

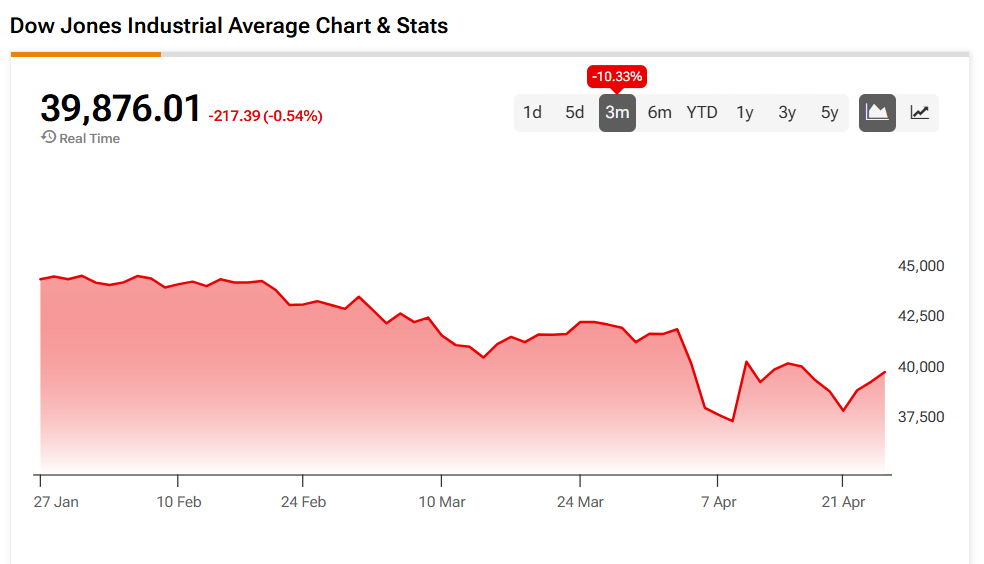

Dow Jones Today: What the Numbers Indicate

Glancing at the Dow Jones today gives us instant answers to the way the market is responding to different events, including:

- Economic data (e.g., employment figures, inflation levels)

- Federal Reserve decisions

- Company earnings releases

- Geopolitical events

For example, if the Dow rockets higher after a robust jobs report, it indicates confidence in economic growth. If it falls after poor corporate profits, it may reflect investor worry about profitability and performance ahead.

Key Drivers of Daily Dow Movement

1. Earnings Reports

Every quarter, publicly traded firms announce earnings figures. A favorable report from a firm such as Apple or Goldman Sachs can make a big impact on the index.

2. Economic Indicators

Indicators such as inflation, employment, and consumer confidence surveys are watched closely. An inflation spike may lead the Dow to fall as investors fear rate hikes.

3. Federal Reserve Policy

Changes in interest rates and Fed monetary policy statements rank among the most powerful drivers of day-to-day Dow action.

4. Global Events

Global tensions, trade negotiations, or significant policy changes in international economies can influence the Dow. Markets tend to respond quickly to news that indicates uncertainty or opportunity.

Tools to track the Dow in real-time

It has never been easier to stay updated on the Dow Jones today with tools and platforms providing real-time information:

- Websites providing financial news such as CNBC, Bloomberg, and MarketWatch

- Investment apps such as Robinhood, Fidelity, or E*TRAD

- Financial television channels that stream live coverage and analysis by experts

They do not just report figures, but also analyze trends, providing useful insights for making decisions.

Who Should Tune in to the Dow?

While professional investors and day traders monitor it minute by minute, the Dow Jones is also a useful benchmark for:

- Long-term investors observing trends over the course of time

- Retirees with portfolios of blue-chip stocks

- Students and professionals wishing to grasp market fundamentals

- Homebuyers and consumers evaluating economic stability prior to significant purchases

Grasping the Dow’s daily fluctuation assists with placing broader financial and economic progress in perspective.

Frequently Asked Questions (FAQs)

- What is meant by when the Dow is up or down?

If the Dow Jones this morning is higher, it generally means that the 30 component stocks have, as a whole, increased in value. This usually indicates optimistic investor sentiment. If lower, the reverse is true—investors could be responding to bad news or economic uncertainty.

- Is the Dow Jones the best gauge of the U.S. economy?

Although the Dow is informative, it only monitors 30 corporations and is price-weighted. To get an overall picture, investors also pay attention to the S&P 500 and Nasdaq Composite.

- Is it possible for the ordinary person to take advantage of watching the Dow?

Yes. Even if you’re not a daily trader, knowing how the Dow performs can help you make smart financial choices and be aware of economic trends that could affect your job, investments, or expenses.

- Where can I access real-time updates of the Dow Jones?

You can monitor current Dow Jones on leading financial news sites, stock exchange platforms, and smartphone apps. These platforms tend to provide market snapshots, expert commentary, and notices based on your preferences.

- What are blue-chip stocks, and how do they tie into the Dow?

Blue-chip stocks are solid, well-established companies with a track record of solid performance. Most members of the Dow fit this mold, so the Dow is a decent representation of how well blue-chip corporations are performing.

Related Financial Terms to Understand

- Stock market index

- S&P 500

- Nasdaq Composite

- Market volatility

- Economic indicators

- Interest rates

- Corporate earnings

These terms tend to come up when there is talk about the Dow Jones and provide more insight into what is affecting the market.

How to Use This Information

Mastering the Dow Jones today can be a powerful addition to your financial education. Whether you’re thinking of tweaking your 401(k), opening a new investment account, or just wish to stay aware, this information enables you to join in conversations that are forging the economy.

By keeping an eye on day-to-day Dow fluctuations, you’re in a stronger position to:

- Assess your investment plans

- Make informed choices about selling or purchasing assets

- Understand the larger economic story that drives job markets, consumer costs, and policy

Final Thoughts

The Dow Jones today is more than a market number—it’s a snapshot in real-time of economic well-being, company performance, and investor sentiment. By monitoring its fluctuations and comprehending the dynamics behind them, you can better navigate the world of finance with enhanced clarity and confidence.